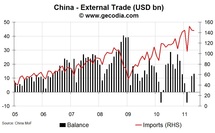

Data for the external trade in China are pointing toward a gradual reduction of the surplus since the beginning of this year. From January to May, the trade balance reached USD +23.2 bn, an important reduction compared to 2010 ($34.8 bn). The fall in the trade surplus is explained by a rapid growth in imports since mid-2010 when exports underperform. For example, in May 2011, imports growth was +28.4 YoY, against +19.4% YoY for exports.

Is this first sign of a structural change in the Chinese economic growth model? The share of household consumption is close to 35% of the GDP in China (2010 data) when investments reach 48% and net exports 4%. The importance of total investment is biggest recorded in the G20. In the largest emerging countries, only India has a share of gross capital formation above 30% (34% of GDP in 2009). The others are close to the developed countries levels (Brazil: close to 20%). So, for China, if imports rise faster, it could indicate that household expenditures fuel the demand for external goods.

But, details are not consistent with that idea. Imports are deeply impacted by commodity prices on an annual basis. WTI price has risen by 39% YoY in May and Brent price by 52%. Consequently, the change in price for crude oil imports has cost to China $17 bn in the first 5 months of 2011 (if prices have been stable compared to 2010, total Chinese’s imports other this period would have been $17 bn lower). Only that could explain why the trade surplus has shrunk.

Is this first sign of a structural change in the Chinese economic growth model? The share of household consumption is close to 35% of the GDP in China (2010 data) when investments reach 48% and net exports 4%. The importance of total investment is biggest recorded in the G20. In the largest emerging countries, only India has a share of gross capital formation above 30% (34% of GDP in 2009). The others are close to the developed countries levels (Brazil: close to 20%). So, for China, if imports rise faster, it could indicate that household expenditures fuel the demand for external goods.

But, details are not consistent with that idea. Imports are deeply impacted by commodity prices on an annual basis. WTI price has risen by 39% YoY in May and Brent price by 52%. Consequently, the change in price for crude oil imports has cost to China $17 bn in the first 5 months of 2011 (if prices have been stable compared to 2010, total Chinese’s imports other this period would have been $17 bn lower). Only that could explain why the trade surplus has shrunk.

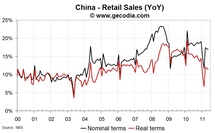

Moreover, even if it is true to say that the household consumption in China is growing fast, its pace is too slow to become the main engine for economic activity. Since the beginning of this year, retail sales in volume are decelerating. 2011 Q1 national account data underline that household consumption in urban areas remained stable around 6% YoY in real terms.

Economic Impacts

We do not see any change in the Chinese’s growth pattern. Consumption is indeed growing fast (manufactured goods imports January-May: +3% YoY). But, its share in GDP is too small and real consumption too slow for enabling China to grow at more than 8% on an annual basis (Q1 2011: +9.7%).

Investments and exports remain crucial for China. This is a great source of risks on the medium term: monetary policy behind the curve in order to maintain enough credit flow for financing investment; crisis of over-investment; asset-price bubbles (real estate).

Economic Impacts

We do not see any change in the Chinese’s growth pattern. Consumption is indeed growing fast (manufactured goods imports January-May: +3% YoY). But, its share in GDP is too small and real consumption too slow for enabling China to grow at more than 8% on an annual basis (Q1 2011: +9.7%).

Investments and exports remain crucial for China. This is a great source of risks on the medium term: monetary policy behind the curve in order to maintain enough credit flow for financing investment; crisis of over-investment; asset-price bubbles (real estate).

World GDP

World GDP