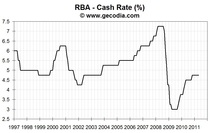

The RBA let the cash rate unchanged in May, at 4.75%. Australia’s interest rate is stable since November 2010.

In the statement, the RBA emphasizes that “national income is growing strongly” despite a still prudent consumer and adverse impact coming from the floods. For the bank, “over the medium term, overall growth is likely to be at trend or higher”.

In this context, inflationary pressures are high in Australia but the “Bank expects that, as the temporary price shocks dissipate over the coming quarters, CPI inflation will be close to target over the year ahead”. However, “over the longer term inflation can be expected to increase”.

So even if, the BRA judged that there is no rush to tighten further the monetary policy (currently “mildly restrictive”) in Australia, the Bank clearly has a hawkish bias.

The key point in the close future will be the evolution in total and underlining inflation in Australia. The Bank does not expect to see a sharp rise in prices on the short run. Nothing is less sure, with a downward trend in unemployment and still strong GDP growth.

Market Impacts

Forex: the AUD/USD stays on the downside (i.e. appreciation of the AUD) and RBA’s decision did not accentuate the trend.

In the statement, the RBA emphasizes that “national income is growing strongly” despite a still prudent consumer and adverse impact coming from the floods. For the bank, “over the medium term, overall growth is likely to be at trend or higher”.

In this context, inflationary pressures are high in Australia but the “Bank expects that, as the temporary price shocks dissipate over the coming quarters, CPI inflation will be close to target over the year ahead”. However, “over the longer term inflation can be expected to increase”.

So even if, the BRA judged that there is no rush to tighten further the monetary policy (currently “mildly restrictive”) in Australia, the Bank clearly has a hawkish bias.

The key point in the close future will be the evolution in total and underlining inflation in Australia. The Bank does not expect to see a sharp rise in prices on the short run. Nothing is less sure, with a downward trend in unemployment and still strong GDP growth.

Market Impacts

Forex: the AUD/USD stays on the downside (i.e. appreciation of the AUD) and RBA’s decision did not accentuate the trend.

World GDP

World GDP