The non-farm payroll increased strongly in April 2011 in the US. Total employment was up by 244k (March: +221k). Excluding the census temporary boost of 2010, this is the strongest increase registered since March 2006. In the private sector, jobs expanded by 268k and +1.6% YoY (again unseen since 2006). In both case, data were better than expected (+185k for total employment and +200k for private employment).

Wage moderation seems to have come to an end, with private wage increasing by 2.1% (stable since January).

Wage moderation seems to have come to an end, with private wage increasing by 2.1% (stable since January).

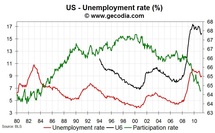

On the contrary, the unemployment rate in the US was higher than expected, rising to 9% from 8.8% in March. The largest measure of labour under utilization (U6 that includes discouraged people and part time for economic reasons) is up to 15.9% from 15.7%. This is disappointing but the overall tone of the report is positive.

Economic Impacts

An unemployment rate up and still very high gives more argument to the Fed for maintaining its current policy stance.

On the economic side, a strong increase in employment together with a stable wage growth is good news for income and consequently consumption.

Market Impacts

Forex: After the publication, the EUR/USD and the GBP/USD are up with some volatility (USD depreciates).

Commodities: gold is up at 1490 $/oz. WTI oil price is also up and close to 100 $/b.

Economic Impacts

An unemployment rate up and still very high gives more argument to the Fed for maintaining its current policy stance.

On the economic side, a strong increase in employment together with a stable wage growth is good news for income and consequently consumption.

Market Impacts

Forex: After the publication, the EUR/USD and the GBP/USD are up with some volatility (USD depreciates).

Commodities: gold is up at 1490 $/oz. WTI oil price is also up and close to 100 $/b.

World GDP

World GDP