The Greek crisis deepened due to political turmoil and a lack of consensus between euro area’s main leaders. 5Y CDS is close to 2000bp (i.e. a default with very little recovery priced in by the markets) and a spread of more than 1 400bp for Greek 10Y yield against the Bund. Even if the government survived a confidence vote and reshuffled, the situation remains very tensed on the internal side (no consensus on austerity with the opposition, lots of contestation from unions and the far left - very active in Greece).

As we noted in a previous article, Greece will need around EUR 240bn from 2012 to 2015 for financing both redemption and the coming deficits. Avoiding a default on a medium term perspective (2015) will depend on three main elements: ability for the Greek government to respect its target for the future deficits; ability of the UE+IMF to provide enough aid to cover 2012-2015 needs; ability to get a good amount of money from privatization.

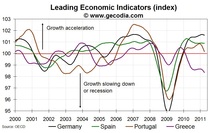

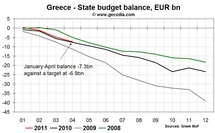

With a prolonged recession or a sluggish growth, it will be hard for the Greek deficit to stay on track, as revenue fall short of expectations. If we take a look at the composite leading indicator for Greece published by the OECD (cf. chart above, leading economic activity by 6 months), the situation is quite clear. For the coming month, do not expect to see a decent growth in Greece. GDP growth forecasts for Greece are also quite low. That’s the reason why the Greek government has missed its target for public deficit for January-April (cf. graph hereunder). This triggered new austerity measures and the political mess.

As we noted in a previous article, Greece will need around EUR 240bn from 2012 to 2015 for financing both redemption and the coming deficits. Avoiding a default on a medium term perspective (2015) will depend on three main elements: ability for the Greek government to respect its target for the future deficits; ability of the UE+IMF to provide enough aid to cover 2012-2015 needs; ability to get a good amount of money from privatization.

With a prolonged recession or a sluggish growth, it will be hard for the Greek deficit to stay on track, as revenue fall short of expectations. If we take a look at the composite leading indicator for Greece published by the OECD (cf. chart above, leading economic activity by 6 months), the situation is quite clear. For the coming month, do not expect to see a decent growth in Greece. GDP growth forecasts for Greece are also quite low. That’s the reason why the Greek government has missed its target for public deficit for January-April (cf. graph hereunder). This triggered new austerity measures and the political mess.

Economic Impacts

CLI is another proof that the scepticism is justified about the deficit targets. On a longer term, the return to fiscal sustainability will require a primary surplus between 5% and 10 % of GDP for almost 10 years for bringing down the level of debt to 60% of GDP. With ongoing political mess and low growth the odds Greece can achieve that are more than low. Some kind of restructuring appears to be very likely in the coming years. But the main idea right now is to delay this problem far away in the future in order to calm down the markets and avoid a systemic crisis through losses for European banks and contagion to Spain and Italy. Consequently, the stability of the European economy is closely linked governmental stability in Greece. So, the Euro Debt Crisis is here to stay!

CLI is another proof that the scepticism is justified about the deficit targets. On a longer term, the return to fiscal sustainability will require a primary surplus between 5% and 10 % of GDP for almost 10 years for bringing down the level of debt to 60% of GDP. With ongoing political mess and low growth the odds Greece can achieve that are more than low. Some kind of restructuring appears to be very likely in the coming years. But the main idea right now is to delay this problem far away in the future in order to calm down the markets and avoid a systemic crisis through losses for European banks and contagion to Spain and Italy. Consequently, the stability of the European economy is closely linked governmental stability in Greece. So, the Euro Debt Crisis is here to stay!

World GDP

World GDP