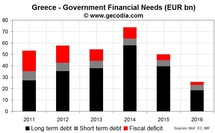

If the Greek government respects the targets for the next 5 years, the fiscal deficit will decrease to only EUR 2bn in 2015 from EUR 18bn in 2011. That seems quite reasonable. But, the main problem will be redemptions of the public debt. Currently, the outstanding amount of debt for the general government is 355bn (close to 160% of GDP), including 283bn of sovereign marketable bonds and 53bn of loans coming from the Financial Support Mechanism.

In the coming years, redemptions will peak in 2014 (58bn). On a cumulated basis, the amount of redemptions will be 188bn from 2012 to 2015. Adding the fiscal deficit, the Greek government will need close 210bn from 2012 to 2015 to cover its financing gap (2013 to 2014: 115bn).

Economic Impacts

According to various sources, the IMF, the EU and euro area governments are close to an agreement aimed to cover the financing gap for 2013 and 2014. The initial bailout was aimed to buy time. Greece was expected to return to normal funding (i.e. bond issuance) by 2013. It is now clearly impossible and the only way to avoid a default is to agree on a second bailout.

The package is expected to be close to 80bn (IMF+EU). The rest will come from privatization (25bn expected) and some involvement from the private sector (20 to 30bn mainly from Greek banks). Again, this kind of solution buys more time but does not fix the redemption problem (i.e. structural insolvency).

In the coming years, redemptions will peak in 2014 (58bn). On a cumulated basis, the amount of redemptions will be 188bn from 2012 to 2015. Adding the fiscal deficit, the Greek government will need close 210bn from 2012 to 2015 to cover its financing gap (2013 to 2014: 115bn).

Economic Impacts

According to various sources, the IMF, the EU and euro area governments are close to an agreement aimed to cover the financing gap for 2013 and 2014. The initial bailout was aimed to buy time. Greece was expected to return to normal funding (i.e. bond issuance) by 2013. It is now clearly impossible and the only way to avoid a default is to agree on a second bailout.

The package is expected to be close to 80bn (IMF+EU). The rest will come from privatization (25bn expected) and some involvement from the private sector (20 to 30bn mainly from Greek banks). Again, this kind of solution buys more time but does not fix the redemption problem (i.e. structural insolvency).

World GDP

World GDP