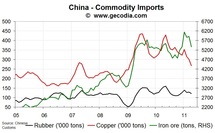

In May 2011, Chinese main commodity imports are either stable or down. This is consistent with a substancial economic slowdown in the greatest emerging country.

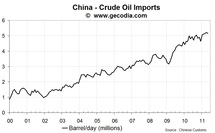

In May, Chinese crude oil imports were slightly down to 5.10 millions barrels a day from 5.26 millions b/d in April. Since the beginning of this year, petroleum imports are in a range from 5.1 to 5.3 millions b/d. The upward trend observed since the Spring 2009 seems broken.

For the other main commodity imports, a correction is under way. For iron ore, such a move is not a surprise after the sharp increase in the Chinese demand in the end of 2010. But, for the others, the contraction is sharp both on annual (copper: 36%; rubber: -18%; aluminium: -15%) and monthly basis.

In May, Chinese crude oil imports were slightly down to 5.10 millions barrels a day from 5.26 millions b/d in April. Since the beginning of this year, petroleum imports are in a range from 5.1 to 5.3 millions b/d. The upward trend observed since the Spring 2009 seems broken.

For the other main commodity imports, a correction is under way. For iron ore, such a move is not a surprise after the sharp increase in the Chinese demand in the end of 2010. But, for the others, the contraction is sharp both on annual (copper: 36%; rubber: -18%; aluminium: -15%) and monthly basis.

Economic Impacts

Stagnation or contraction for major inputs of the Chinese industry cannot be taken positively. More precisely, the downward trend for copper underlines that the Chinese economy is loosing steam fast.

This report is a new proof that something not cool for the global economic outlook is going on in China. Of course, a moderation in the rate of growth is exactly what the local authorities want. But, by raising the interest rates to aggressively since last autumn, the risk of a hard landing has increase gradually and has to be taken seriously now.

In conclusion, investors should taken this bad signal seriously and monitor very closely. Expect to have more bad news coming from in next week data in China (IP, retail sales, investments and inflation).

Stagnation or contraction for major inputs of the Chinese industry cannot be taken positively. More precisely, the downward trend for copper underlines that the Chinese economy is loosing steam fast.

This report is a new proof that something not cool for the global economic outlook is going on in China. Of course, a moderation in the rate of growth is exactly what the local authorities want. But, by raising the interest rates to aggressively since last autumn, the risk of a hard landing has increase gradually and has to be taken seriously now.

In conclusion, investors should taken this bad signal seriously and monitor very closely. Expect to have more bad news coming from in next week data in China (IP, retail sales, investments and inflation).

World GDP

World GDP